Homes Are Selling Quickly Nationwide

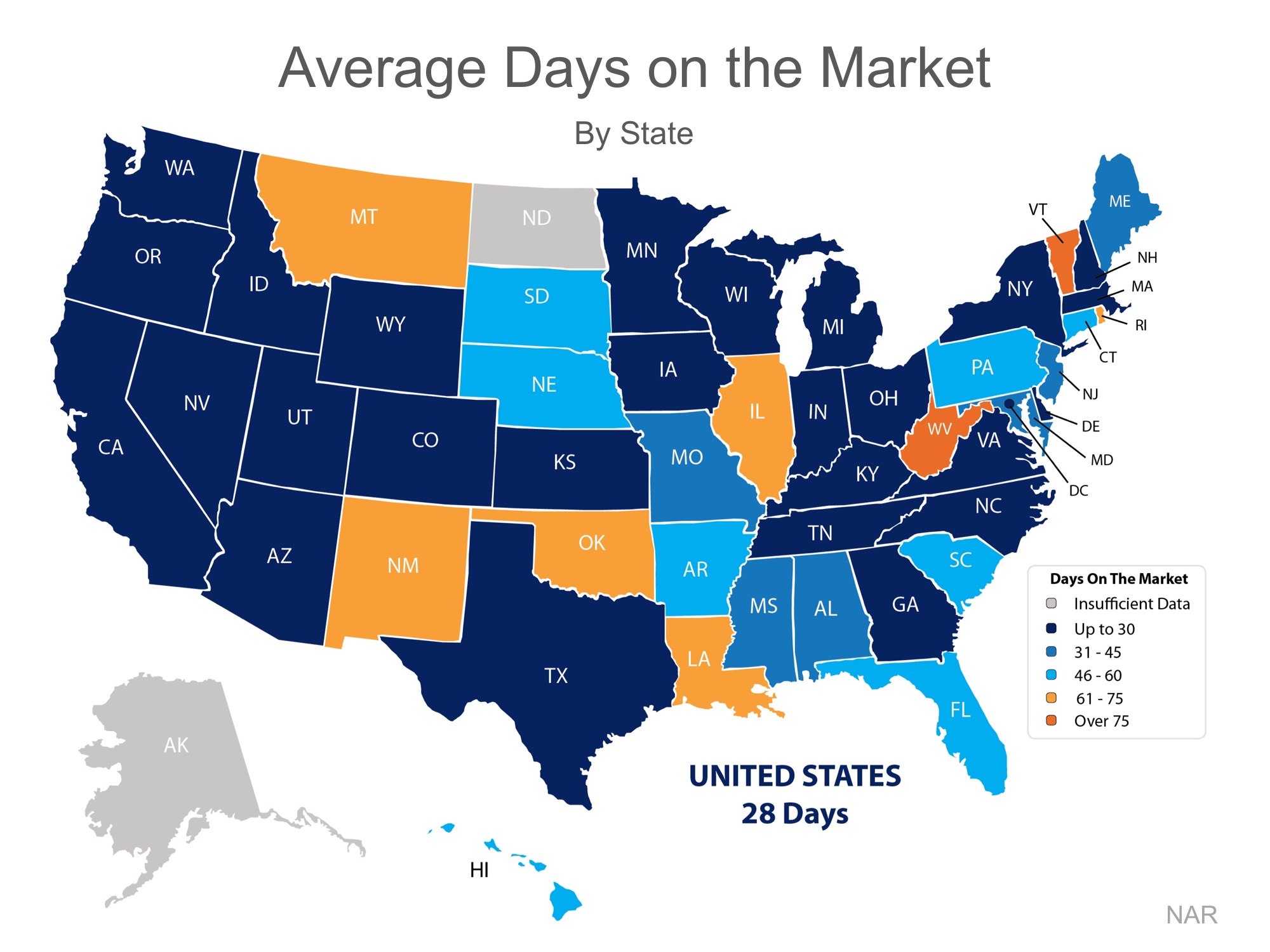

The National Association of Realtors (NAR) recently released their latest Existing Home Sales Report, which revealed that homes were on the market for an average of 28 days in June. This is a slight increase from the 27 days reported in May, but down from 34 days reported a year ago.

54% of homes across the country were on the market for less than a month in June!

Among the 27 states with homes selling in 30 days or less are Washington, Utah, California, and Colorado. The map below was created using results from NAR’s Monthly Realtors Confidence Index Survey.

Bottom Line

Buyer demand is increasing as the inventory of homes available for sale remains low. If you are thinking about listing your home for sale this year, let’s meet up so I can help you take advantage of current market conditions!

Call Me For All of Your Real Estate Needs!!

Call Me For All of Your Real Estate Needs!!

Debbie Mignogna, ABR, SRS

Your Blue Bell Realtor

BHHS Fox & Roach Realtors

267-640-1120

Debbie Mignogna, ABR, SRS

Your Blue Bell Realtor

BHHS Fox & Roach Realtors

267-640-1120