Top 5 Reasons Why Millennials Choose to Buy

![Top 5 Reasons Why Millennials Choose to Buy [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/09/08111957/Millennials-Choose-to-Buy-STM-1046x1354.jpg)

![Top 5 Reasons Why Millennials Choose to Buy [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/09/08111957/Millennials-Choose-to-Buy-STM-1046x1354.jpg)

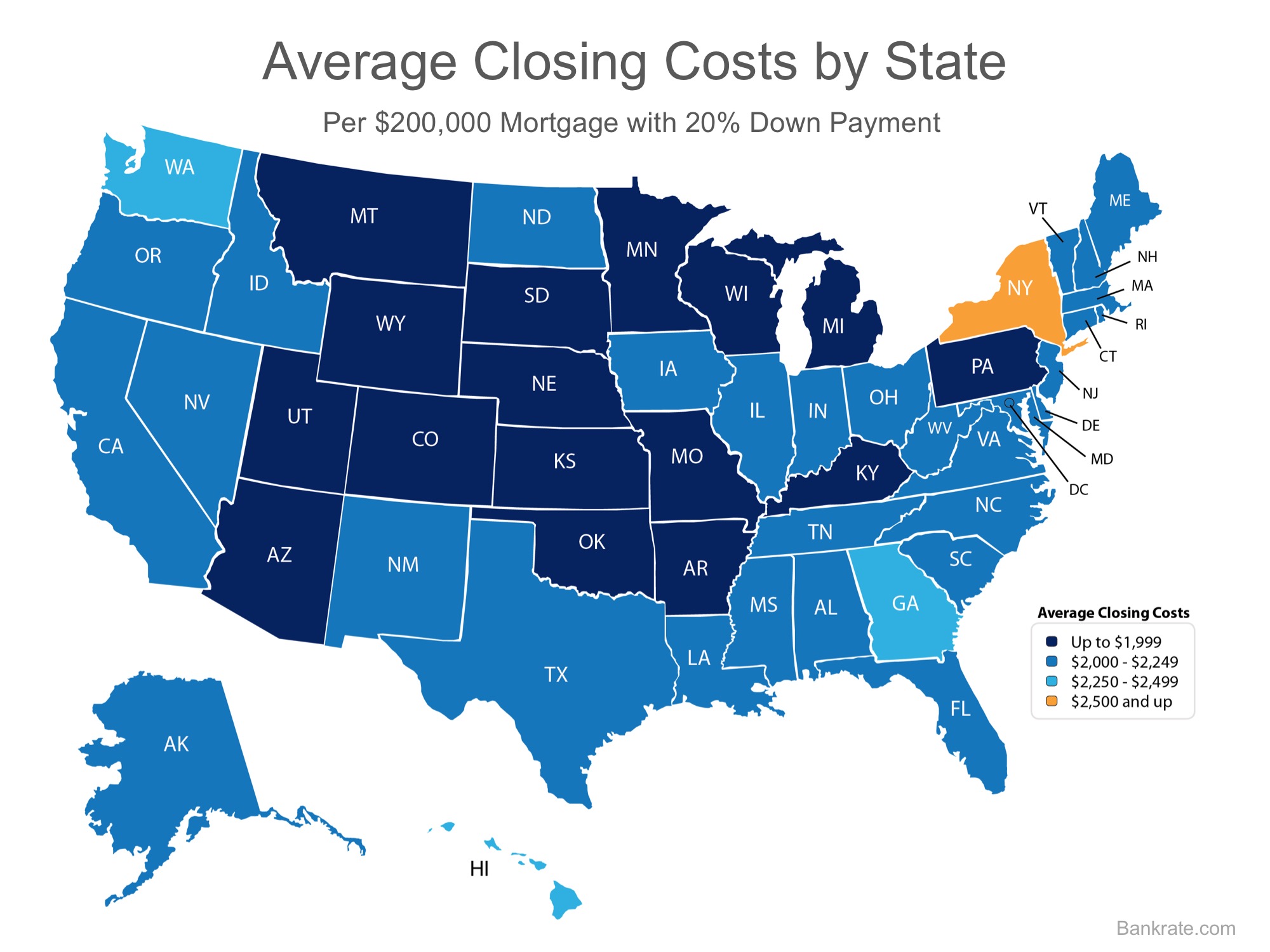

Some Highlights:

- “The majority of millennials said they consider owning a home more sensible than renting for both financial and lifestyle reasons — including control of living space, flexibility in future decisions, privacy and security, and living in a nice home.”

- The top reason millennials choose to buy is to have control over their living space, at 93%.

- Many millennials who rent a home or apartment prior to buying their own homes dream of the day that they will be able to paint the walls whatever color they'd like, or renovate an outdated part of their living space.

- Source: Keeping Current Matters

Call Me For All of Your Real Estate Needs!!

- “The majority of millennials said they consider owning a home more sensible than renting for both financial and lifestyle reasons — including control of living space, flexibility in future decisions, privacy and security, and living in a nice home.”

- The top reason millennials choose to buy is to have control over their living space, at 93%.

- Many millennials who rent a home or apartment prior to buying their own homes dream of the day that they will be able to paint the walls whatever color they'd like, or renovate an outdated part of their living space.

- Source: Keeping Current Matters

Debbie Mignogna, ABR, SRS

Your Blue Bell Realtor

BHHS Fox & Roach Realtors

267-640-1120

Debbie Mignogna, ABR, SRS

Your Blue Bell Realtor

BHHS Fox & Roach Realtors

267-640-1120

![Lack of Existing Home Inventory Slows Sales Heading into Fall [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/09/20125109/20170922-EHS-Report-STM-1046x1354.jpg)